While the introduction of a capital gains tax in Malaysia would broaden the tax net to include more capital assets it could also adversely impact the income of genuine long-term investors who rely on dividends and capital gains. In arriving at effective capital gains tax rates the.

Real Property Gains Tax Rpgt 2022 In Malaysia How To Calculate It Iproperty Com My

Instructions for obtaining relief at source or a refund of withholding tax where these are available through Clearstream Banking.

. There is no difference in Malaysia Property Gain Tax Rate for a foreign-owned property title name under individuals or companies. In an effort to broaden the tax base and increase revenue so that Malaysia can be on par with other countries in the region the government may or. Capital gains tax is only applicable to gains from the sale of real properties or shares in a real property company.

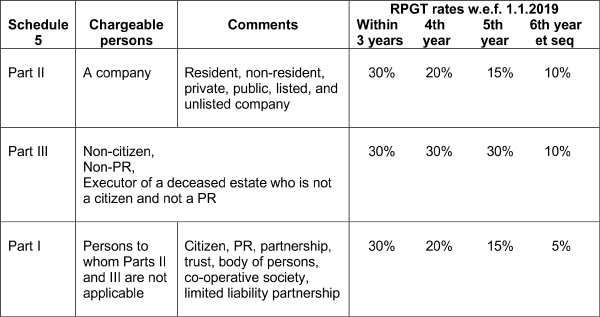

Presently Malaysia does not impose CGT on the disposal of investments or capital assets other than real property gains tax RPGT which is levied on chargeable gains derived from the disposal of. Real Property Gains Tax RPGT is a form of Capital Gains Tax that homeowners and businesses have to pay when disposing of their property in Malaysia. An amount of RM10000 or 10 of the chargeable gain whichever is greater accruing to an individual.

Which mean no need to pay income tax. The over-55 home sale exemption was a tax law that provided homeowners over age 55 with a one-time capital gains exclusion. Under the Malaysian Income Tax Act 1967 the government does not impose a tax on any profits or gains deriving from any price increase when you sell a stock.

Real Property Gains Tax RPGT is a capital gains tax imposed on gains on disposals of real property located in Malaysia or shares in an RPC. New and improved tax. Gain accruing to an individual who is a citizen or a permanent resident in respect of the disposal of one private residence.

While income is taxable in Malaysia capital gains on shares are not subject to tax. Your capital assets are also not subject to this tax system. Tax rate to pay will be RM 42400 x 10 RM 4240.

RPGT is a tax on gains from the sale of real property in. This Market Taxation Guide Malaysia provides the following details. However if the activity of trading in shares is frequent enough the Malaysian Inland Revenue Board IRB may treat the gain as a revenue gain which will be taxable.

There are no capital gains taxes in Malaysia if the asset is not land or building related. RPGT rate for disposal of chargeable asset under Part I Schedule 5 RPGT Act. It is not under badges of trade.

Dividends are exempt in the hands of shareholders. While RPGT rate for other categories remained unchanged. However when it is frequent enough IRB will treat it as an active income and do require income tax liability.

This means that if one day you decide to sell your house you have to pay taxes on. Level 4 Lot 6 Jalan 5121746050 Petaling Jaya SelangorMalaysia Tel. An RPC is a company that owns real property in Malaysia or shares in other RPCs to the extent the value of its real property or shares in other RPCs or both is 75 percent or more of the total tangible asset value of the.

What you would need to pay is the real property gains tax RPGT. In Malaysia any sale made from your investments is not subject to the capital gains tax. Disposal of assets to REITs and Property Trust Funds.

Rate 112010 - 31122011. And then I found below. 603-7785 2624 603-7785 2625.

Capital gains tax CGT rates Headline corporate capital gains tax rate Generally gains on capital assets are not subject to tax except for gains arising from the disposal of real property situated in Malaysia which is subject to RPGT up to 30. MALAYSIA does not tax capital gains except gains from property disposals under the Real Property Gains Tax Act RPGT. ANY decision to impose a capital gains tax on the trading of shares by retail and institutional investors in Bursa Malaysia will be detrimental for the Malaysian equity market.

Such move will inevitably make Malaysia less competitive while triggering further outflow of foreign funds according to CGS-CIMB Research. In actual fact you only pay an approximate 5 tax rate not 10. Reference information about all taxes applied at source to securities deposited in Clearstream Banking 1.

Any capital gains on shares are not subject to tax under the Malaysian Income Tax Act 1967 ITA. According to KPMG in Malaysias Head of Tax Tai Lai Kok this can only be managed if a mechanism similar to the Real Property Gains Tax. Generally gains on capital assets are not subject to tax except for gains arising from the disposal of real property situated in Malaysia which is subject to RPGT see the Other taxes section for more information.

Capital gains taxes. For the period of 112022 and thereafter disposal in the sixth year after the date of acquisition of the chargeable asset is changed back to nil. 3 Say of LHDN IRB.

Headline individual capital gains tax rate. Only need to pay Capital Gains Tax but Capital Gains Tax is not exist in Malaysia means no need to pay tax at all. Malaysia is under the single-tier tax system.

How the Capital Gains Tax Works. Individuals who met the requirements could exclude up to 125000 of capital gains on the sale of their personal residences. Tax Calculator is a web-based solution where individuals can upload transactions to download a Form 8949 which is used to calculate capital gains for US tax returns.

Take note that capital gain is not taxable in Malaysia except for gains derived from the disposal of real property or on the sale shares in a real property company. Real Property Gains Tax RPGT in Malaysia 2022 Follow Loanstreet on Facebook Instagram for the latest updates. In general capital gains in the country are not subject to income tax.

Disposal of assets in connection with securitisation of assets. At what age are you exempt from capital gains tax. It connects directly with multiple exchanges allowing users to insert API keys andor upload exchange-formatted CSV files.

Which is really confusing one say it is under Badges of Trade another say it is not. Net gains on the property.

Tax Identification Numbers In Laos Compliance By June 2021

Real Property Gains Tax Part 1 Acca Global

Tax And Investments In Malaysia Crowe Malaysia Plt

Real Property Gains Tax Rpgt In Malaysia Tax Updates Budget Business News

Budget 2022 These Companies May Be Subject To The One Off 33 Prosperity Tax The Edge Markets

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Top 10 Crypto Tax Free Countries 2022 Koinly

2022 Updates On Real Property Gain Tax Rpgt Property Taxes Malaysia

Real Property Gains Tax Part 1 Acca Global

Capital Gains Losses From Selling Assets Reporting And Taxes

Everything You Need To Know About Capital Gains Tax

Real Property Gains Tax Rpgt In Malaysia And Why It S So Important

Tax On Rental Income 5 Rules You Must Know If You Rent Out Property In Malaysia

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

Real Property Gain Tax Rpgt For Industrial And Commercial Properties 2021 In Malaysia Industrial Malaysia

Financing And Leases Tax Treatment Acca Global

Real Property Gain Tax Rpgt For Industrial And Commercial Properties 2021 In Malaysia Industrial Malaysia

- kebaikan memakai kacamata hitam

- dikurniakan in english

- rambut panjangperempuan agama sikh

- minyak rambut untuk meluruskan

- taman desa permai port dickson

- public.moe.gov.my daftar masuk

- gaya rambut terbaru pria

- nota rbt tingkatan 3

- cek tracking jne reg

- desain kamar mandi minimalis toilet jongkok

- surat permohonan latihan industri

- jenis bateri kereta yang tahan lama

- daun salad in english

- maksud nama muhammad iman

- alamat taman sri penang

- burger king ttdi

- hiasan dalaman ruang tamu flat

- cara bayar kereta melalui cimb click

- budget hotel in ipoh

- cara menghilangkan rambut rosak